What is Farm Insurance?

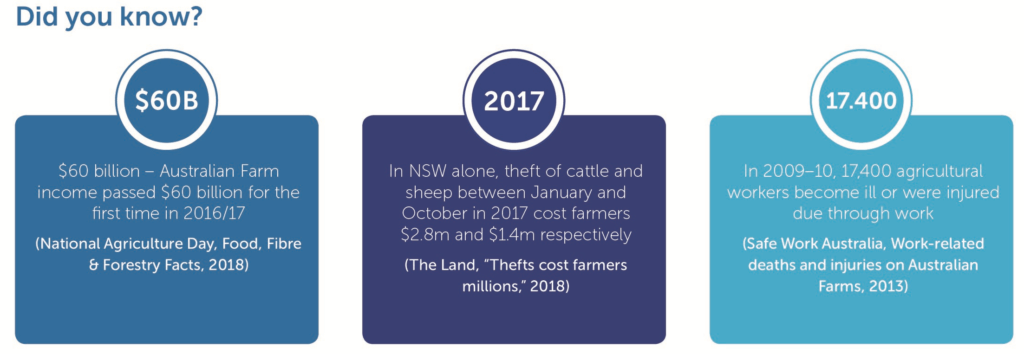

Working on the land brings many rewards – but just as many risks. As a farm owner, you’re vulnerable to bushfires that can destroy livestock or damage your buildings and other property; machinery breakdown which can cost you time and money; personal illness or a serious accident; or even a claim from a guest injured on your property.

That’s why farm insurance can help protect your farm and its produce, and the wellbeing of you, your family and the people that pass through your property.

Who should consider it?

Whether you’re a large-scale crop grower or livestock producer or a small family or hobby farm. Farm insurance can help protect your farm, its produce and livestock – and the people who benefit from it.

“The total value of principal Australian agricultural commodities (crops, livestock and livestock products) produced in Australian in 2016-17 was $39,671 million” – Australian Bureau of Statistics, 2018

What can it cover?

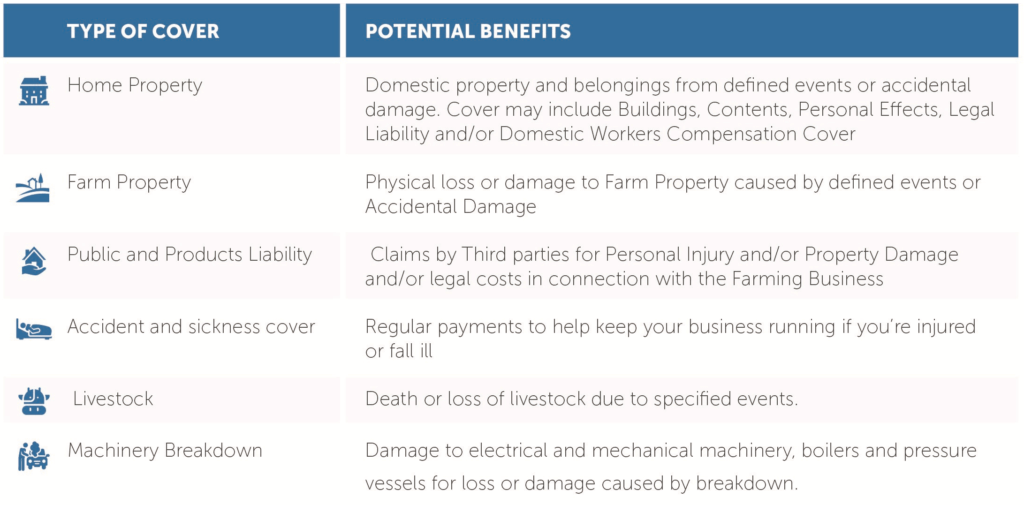

Farm insurance can be tailored to cover your home and farm buildings, livestock, vehicles, equipment and more. It can also safeguard you against theft and loss of income. For example, a typical Steadfast Farm Pack can cover:

What usually isn’t covered?

Exclusions, the excess you need to pay and limits of liability can vary greatly depending on your insurer. Policies generally won’t include cover for:

- Loss or damage to property caused by gradual deterioration or wear and tear

- Flood

- Loss caused by earth movement unless the earth movement occurs within 72 hours of certain events

- Damage caused by tenants unless the risk is accepted by the insurer.

Case Study

Jason owns a wheat farm in western New South Wales. He owns some expensive farming equipment and vehicles. One night, a fire breaks out in one of his sheds, destroying a tractor and a ute.

Jason’s farm insurance covers the repairs to the shed, replaces the damaged contents, and he’s able to claim the cost of replacing both vehicles after the fire.

Important note

A product disclosure statement (PDS) is available from your Steadfast insurance broker. You should consider the PDS in deciding whether to acquire or continue to hold farm insurance.