What is Landlord Insurance?

Like home insurance, landlord insurance can cover your rental property and its contents against risks like storms, floods and fire. It can also cover the damage that tenants can cause to your contents – and even loss of rental income.

Unlike some landlord policies, Steadfast Direct Landlord insurance can cover holiday rentals and long term rentals.

Why do I need it?

Without landlord insurance, you could lose your valuable investment if it’s damaged or destroyed.

You could also lose income from rent if you’re unable to rent it out during repairs, or if your tenants get evicted or break their lease.

What can Steadfast Direct Landlord Insurance Cover?

Steadfast Direct Landlord Insurance can provide you with extensive protection if your investment property suffers loss or damage. And, unlike some other policies, Steadfast Direct Landlord Insurance automatically includes some additional benefits – and is flexible enough to cater for both short term and long-term rentals.

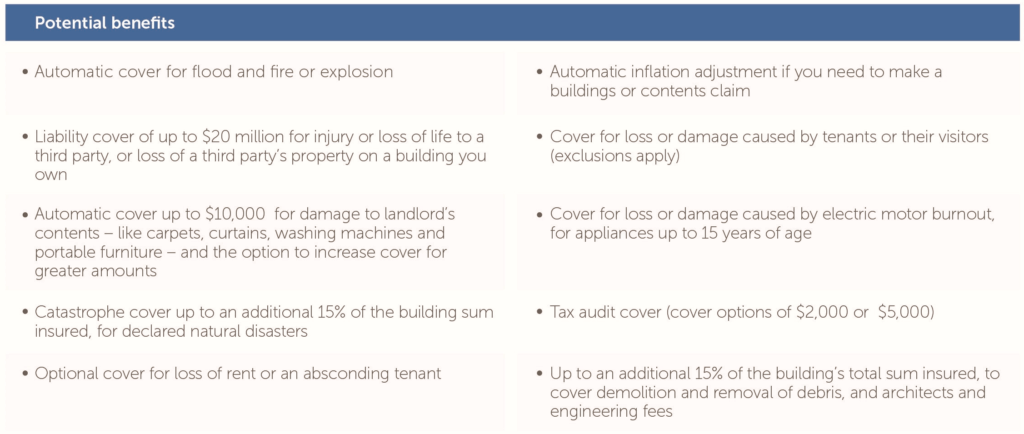

The exact cover you can receive depends on the policy that you take out. But to give you an idea, here are some of the benefits a Steadfast Landlord Insurance policy may include:

What usually isn’t covered?

Each policy is different, but generally you won’t be covered:

- For damage from tenant carelessness or neglect.

- For rust, corrosion, gradual deterioration or wear or tear.

- If your home is unoccupied for 90 continuous days.

There are other exclusions which your Steadfast insurance broker can outline for your. In addition, there is a deductible/excess.

Case Study

Janet and Ross bought an investment property in Sydney’s inner west. They relied on the rent from the property to help cover their mortgage repayments. One year, they rented the property to some tenants who caused extensive damage to some of the walls, floor coverings and doors – and then left owing 12 weeks’ rent. Because the property needed repairs, Janet and Ross were unable to rent it out immediately. Fortunately, the couple had taken out landlord’s insurance and included the rent default option. They successfully claimed on their insurance to cover their repair costs – and just as importantly, their missing rent. this allowed them to make their mortgage repayments and repair the property quickly so they could get new tenants in.

Product disclosure statement (PDS)

A PDS is available from your Steadfast broker. You should consider the PDS in deciding whether to acquire, or continue to hold, Steadfast Direct Landlord Insurance.