What is Corporate Travel Insurance?

When business travel doesn’t go to plan, Corporate Travel Insurance can help to cover out-of-pocket costs to your business and employees.

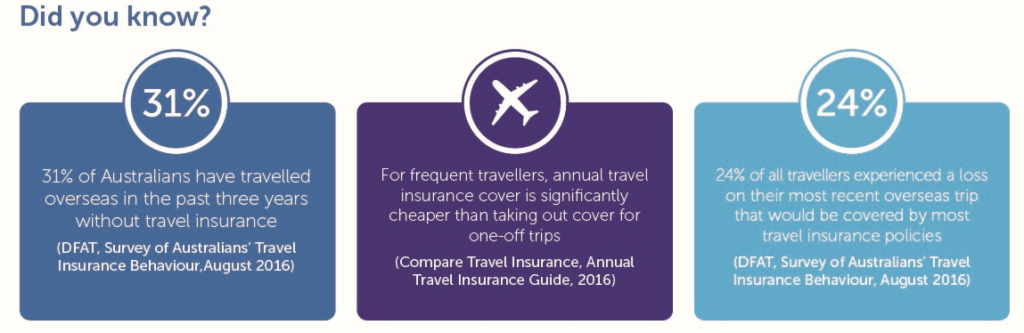

Why do I need it?

If you or your employees need to travel for work, Corporate Travel Insurance can protect your business from financial loss associated with situations such as overseas health emergencies, flight cancellations or lost and stolen baggage.

Corporate Travel insurance is similar to personal travel insurance. It can cover your business for unanticipated travel costs if specific events happen.

Corporate Travel Insurance also covers your directors and employees, and spouses and dependents travelling with them.

“All travel carries with it inherent risks, even short-term travel to familiar overseas locations for meetings and conferences. Risks from political tensions, civil unrest, fraud, severe weather, natural disasters and security of corporate information exist in countries that are not usually considered dangerous.” – Smart Traveller website, 2017

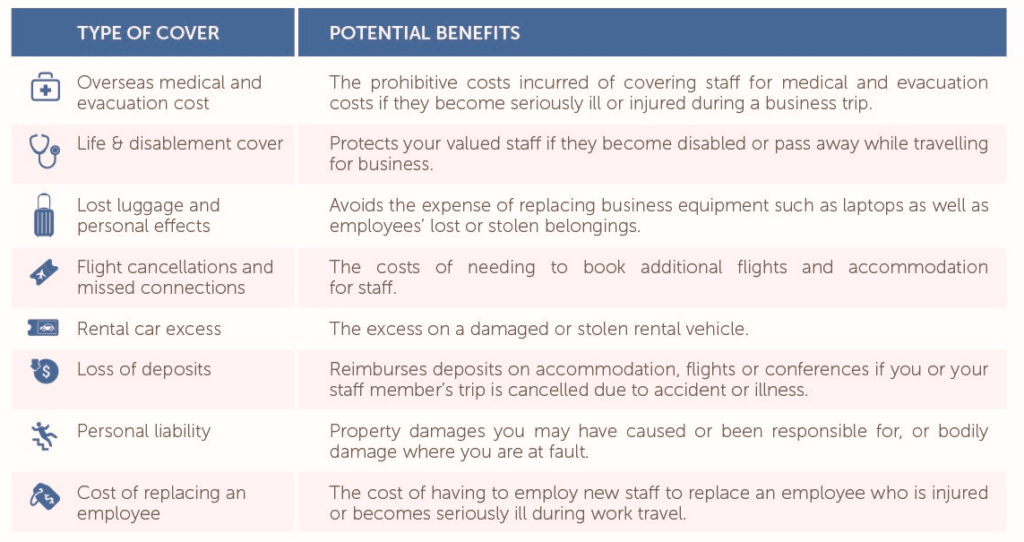

What can it cover?

Corporate Travel Insurance vary in the benefits they provide. Your Steadfast insurance broker can help you find the right product to suit your business travel needs. But to give you an idea, here’s the type of cover that your policy may include:

What usually isn’t covered?

Exclusions and the excess you need to pay can vary greatly depending on your insurer. However, exclusions may include:

- Some pre-existing conditions (your broker can explain these)

- Refunds if your travel provider becomes insolvent

- Pregnancy

- Travelling against medical advice

There are other exclusions which your Steadfast insurance broker can outline for you.

Case Study

While visiting clients in London, your employee falls down a flight of stairs, fracturing their hip and breaking their arm. After being taken to hospital in an ambulance, doctors take x-rays and MRIs of the injured areas. Your employee is informed that they require surgery on their hip and will have to undergo physiotherapy before they will be allowed to fly home to Australia. Their flight is scheduled for the following day and will not need to be cancelled.

A Corporate Travel Insurance policy allows you to recover some or all of these costs. Depending upon the policy, you may be able to make a claim for the medical costs of their surgery and rehabilitation, as well as the flight cancellation and additional accommodation required while your employee undergoes physiotherapy. You may also be able to claim for the hire of someone to take over your employees’ duties until they are back in Australia and fit to return to work.