What is Trade Credit Insurance?

If you trade or sell goods on a credit basis, you’re at risk of bad debt or non-payment by customers. This can disrupt your cashflow and leave you out of pocket.

Trade credit insurance is important for protecting your income and business assets against potential customer failure. With the right cover, you can grow your business confidently, knowing you can be protected if things go wrong.

Who should consider it?

All registered businesses that sell goods and services on credit terms, such as 30 days to pay, should consider trade credit insurance. This includes businesses that trade domestically and internationally.

Some trade credit insurance policies also offer the bonus of working with designated collection agencies to help you recover your debts – taking the pressure off this difficult and time-consuming process.

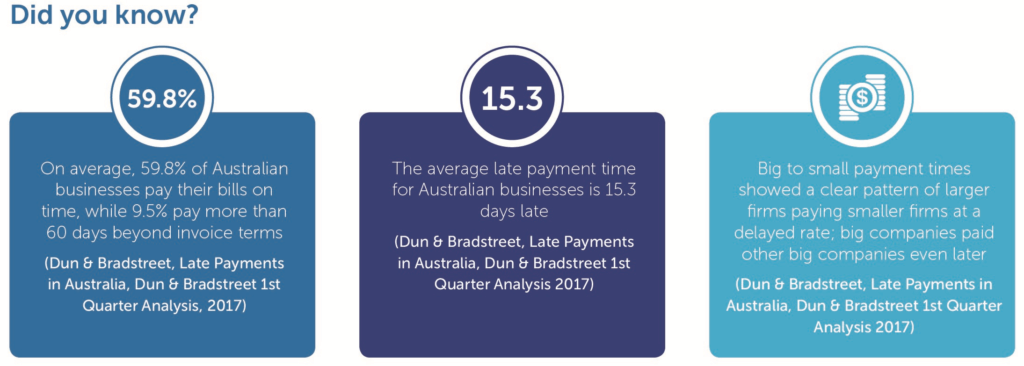

“Late payment times have continued to increase, this suggest that some of the weakness evident in the economy early in 2017 has impacted the time it take firms to pay their bills.” – Stephen Koukoulas, Dun & Bradstreet Economic Adviser

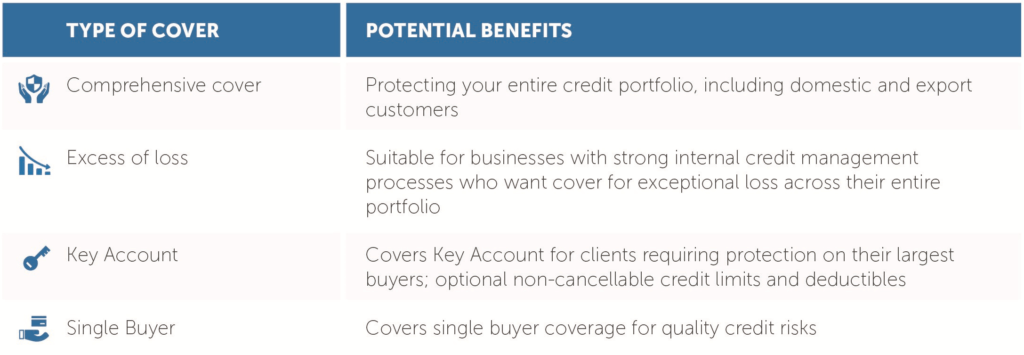

What can it cover?

Depending on the policy, trade credit insurance can cover:

What usually isn’t covered?

Exclusions, the excess you need to pay and limits of liability can vary greatly depending on your insurer. Policies generally won’t include cover for:

- Failure to fulfill any terms and conditions of the contract or to comply with any provisions of the law.

- Failure to obtain any import or export licence necessary for the performance of the contract.

- Any loss related to interest charges, penalties, legal costs, banking costs and currency exchanges rate changes

Case Study

As a small winemaker who has been exporting overseas for five years, Debra faces two challenges. Like other winemakers, she has a long working capital cycle. Secondly, there’s the risk of non-payment, especially among new export clients.

Debra only exports small shipments and takes out trade credit insurance. This strategy pays off, as she sends a shipment to a new client who doesn’t pay. After unsuccessful attempts at getting the payment, Debra makes a success claim on her trade credit insurance.

The insurance payout covers her loss, which fills the gap that the non-payment made in her cash flow. This means she doesn’t have to borrow money to keep her business going.

Important note

This information is provided to assist you in understanding the terms, implications and common considerations in trade credit insurance. It does not constitute advice, and is not complete, so please discuss the full details with your Steadfast insurance broker.