What is Cyber Protection Insurance?

Cyber Protection Insurance is a relatively new form of cover. it’s designed to help protect your business from the financial impact of computer hacking or data breach.

If you see it, report it!

In February 2017, the Senate passed the Privacy Amendment (Notifiable Data Breaches) Bill 2016 – setting up a mandatory nationwide data breach notification scheme. This means if you spot a security breach which may cause unauthorised access or disclosure of personal information, you’re legally required to report it to the Office of the Australian Commissioner within 30 days. You’ll also need to notify the people whose information has been affected.

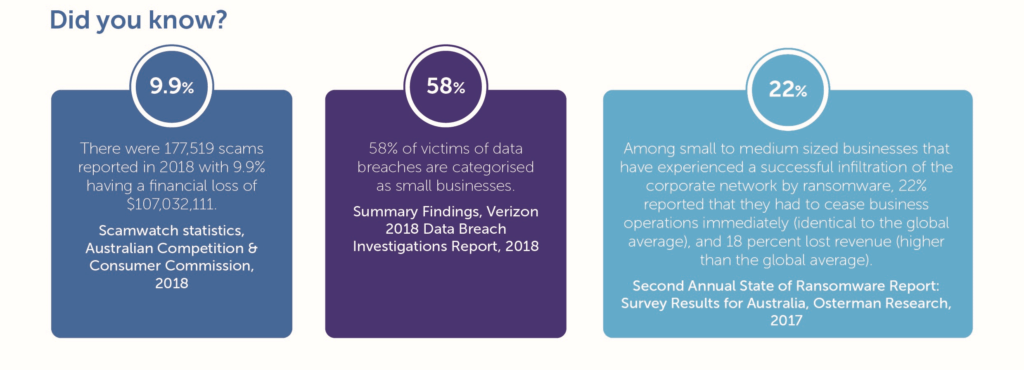

Why do I need it?

If your business has a website or electronic records, you’re vulnerable to cyber hackers. In fact, it’s likely that your business will suffer a cyber attack at some stage.

A cyber attack could cost your business more than money. It could also threaten your intellectual property and put customers’ personal information at risk – which could damage your reputation.

“The scale and reach of malicious cyber activity affecting Australian public and private sector organisations and individuals is unprecedented. The rate of compromise is increasing and the methods used by malicious actors are rapidly evolving” – Prime Minister Malcolm Turnbull, Australia’s Cyber Security Strategy Report 2016

What can it cover?

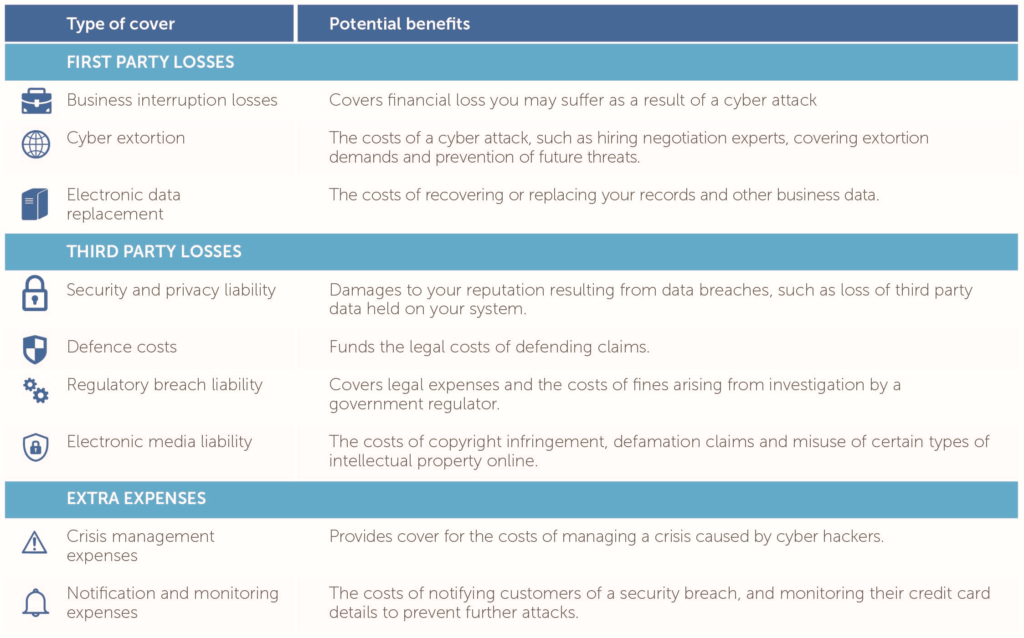

Cyber Insurance policies vary in the benefits they provide.

Your Steadfast insurance broker can help you find the most suitable product that meets the needs of your business.

To give you an idea, here’s the type of cover that your policy may include:

What usually isn’t covered?

Exclusions and the excess you need to pay can vary greatly depending on your insurer. Policies generally won’t include cover for:

- Damage to computer hardware

- Criminal actions committed by you or your business

- A cyber attack based on facts of which you were aware

- Criminals using the internet to steal money from you.

There are other exclusions which your Steadfast insurance broker can outline for you.

Case study

Your employee opens an email attachment infected with a ransomware virus. Access to your systems and data are blocked and the virus software informs you that it will remain unavailable unless you pay the ransom amount. Rather than paying the hacker and opening your business up to further extortion attempts, you hire external IT consultants to recover your back-up data files and upgrade your antivirus software. Over the week it takes to apply these fixes, you have to close your business, causing you to lose revenue. It also affects your reputation with your clients; one of your clients threatens to sue you for the delay which cost them a large amount of money.

A Cyber Protection Insurance policy allows you to recover some of the costs you incur during this incident. Depending on your policy, you may be able to make a claim for losses caused by the interruption to your business, the costs of recovering your data and upgrading your software, and ongoing crisis management expenses.